Renters Insurance in and around McLean

Welcome, home & apartment renters of McLean!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- State Transfers

- Fairfax County

- Arlington County

- Alexandria City

- Montgomery County

- Frederick County

- Anne Arundel County

- Howard County

- Loudoun County

- District of Columbia

- Tysons

- McLean

- Vienna

- Ashburn

- Potomac

- Bethesda

- Fairfax

- Reston

- Falls Church

- Silver Spring

- Herndon

- Hyattsville

- Springfield

- Woodbridge

Home Is Where Your Heart Is

It may feel like a lot to think through work, your busy schedule, managing your side business, as well as savings options and providers for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your mementos, sound equipment and videogame systems in your rented house. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of McLean!

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like the last thing on your mind, and you're wondering if you really need it. But take a moment to think about how much it would cost to replace all the valuables in your rented space. State Farm's Renters insurance can help when thefts or accidents damage your stuff.

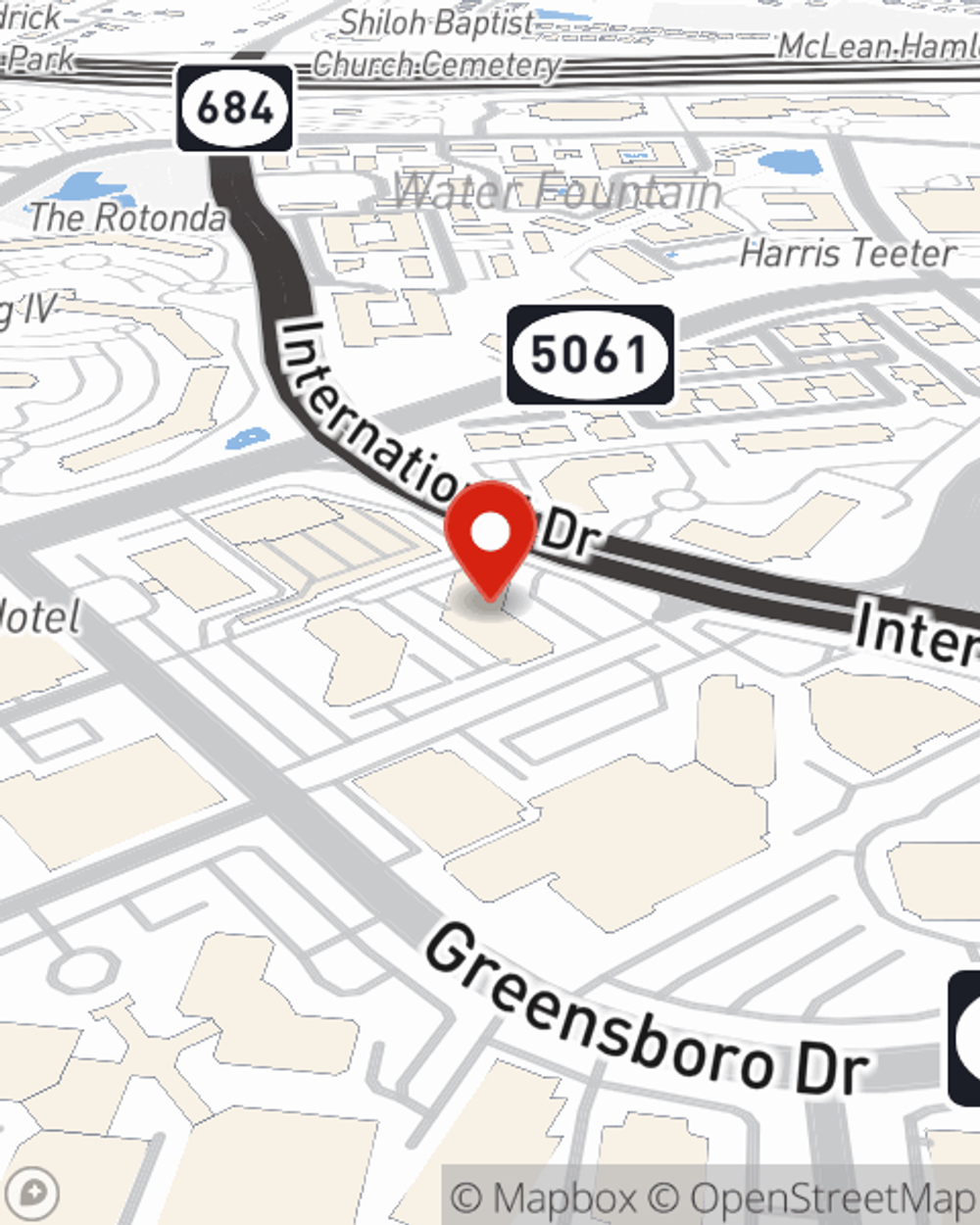

State Farm is a dependable provider of renters insurance in your neighborhood, McLean. Call or email agent Oliver Zelaya today for help understanding your options!

Have More Questions About Renters Insurance?

Call Oliver at (202) 546-2244 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Oliver Zelaya

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.